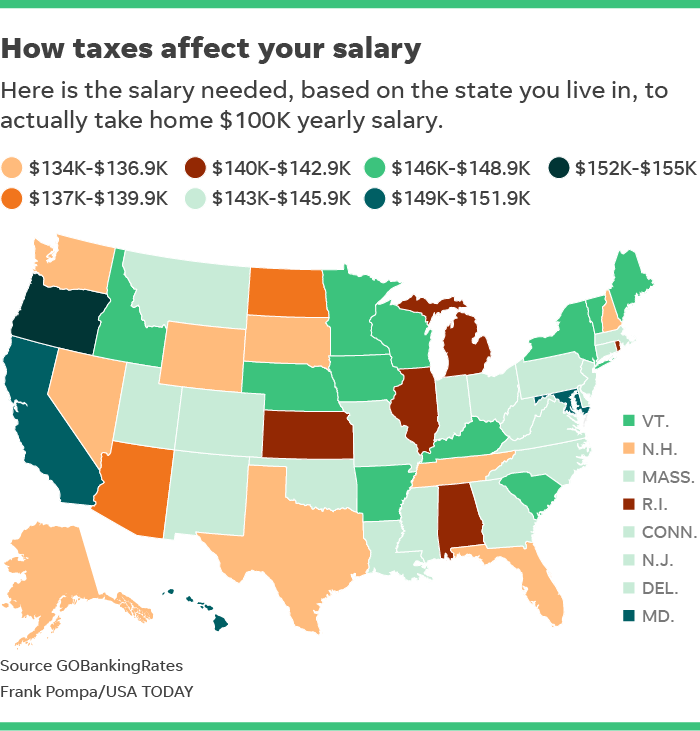

Comparing income taxes: How much you really need to earn to take home $100,000

For many American workers, earning a six-figure income is an impressive milestone. But it might not mean as much after accounting for state and local taxes, particularly in places like New York, California and Maryland.

To see how much you really need to take home $100,000, personal finance site GOBankingRates determined the exact salary, weighing federal, state and local taxes plus withholdings. (With the Tax Cuts and Jobs Act, now is also a good time to take a look at your tax withholding at work.)

More:10 largest cities with highest and lowest salary satisfaction

More:Workplace trends: Workers over 50 find themselves suddenly in a hot job market

More:PMI tax deduction could mean bigger tax refund: Here's what to know

In Oregon, that comes out to $152,810. Since the Beaver State doesn't have a sales tax, high income taxes make up the difference.

Alternatively, residents of Nevada and New Hampshire need only to earn $134,629 on paper to take home $100,000 — that's largely because those states have no income tax on wages and salaries. (New Hampshire does tax income from dividends and interest but Nevada is one of seven states with no personal income taxes on wages, earnings or investment income.)

© CNBC is a USA TODAY content partner offering financial news and commentary. Its content is produced independently of USA TODAY.

More from CNBC:

Here are the highest and lowest state and local taxes

Think twice before moving your business to a low-tax state

Cut your tax bill with these 4 quirky tax deductions